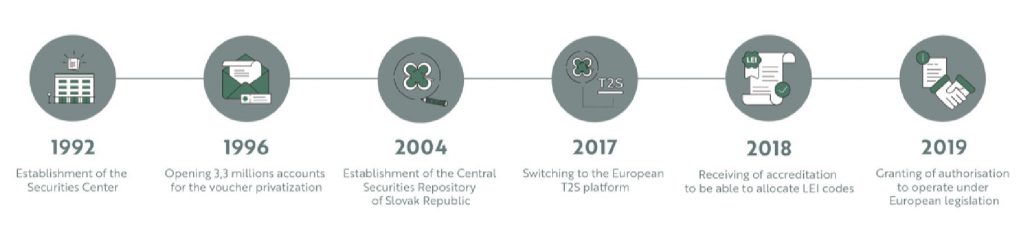

The start of operations dates back to the year 1992, when the issue of transfer of the national property to private ownership in form of voucher privatisation and creating grounds of the capital market in Slovakia was opened. At that very moment the Securities Centre of the Slovak Republic (SCP) was founded. Upon start of the operation more than 2.6 million of accounts for owners of book-entry securities were open, to which shares from the securities issues issued by the companies privatised in the first wave of the voucher privatisation were registered. Relevancy of the Securities Centre of the Slovak Republic was proved also in the year 1994, when SCP became a member of the Association of National Numbering Agencies (ANNA) that brings together companies assigning codes to securities in compliance with the international standards. Second wave of the voucher privatisation in which SCP played an important role came through in Slovakia in the middle of nineties. During that period the Securities Centre credited bonds of the National Property Fund of the Slovak Republic to the owner’s accounts of 3.3 million of residents. The Securities Centre of the Slovak Republic was active also in the Central European region. In the year 1998 it became the founding member of the Central and Eastern European Central Securities Depositories Association (CEECSDA), that was incorporated to the European Central Securities Depositories Association (ECSDA) in 2006.

Large year-to-year increase in volume of provided services was seen in the first years of the new millennium. For example in the year 2001 increase in services reached level higher than 23%. The year 2014 was particularly outstanding in the history of the Central Depository. The Securities Centre of the Slovak Republic was transformed, in compliance with the new legal regulations, to Centrálny depozitár cenných papierov SR, a.s. (CDCP) in the form as it is known today. By entering into relations with neighbouring countries immediately after the transformation the Central Depository was integrated into the Single European Capital Market that has just been created. In the year 2006 the Central Depository granted membership to the first foreign member which was the Polish Central Depository (KDPW). In March 2006 the Bratislava Stock Exchange (‘BSSE’ hereinafter) has become a 100-percent shareholder of CDCP, as a result of in-kind contribution of state property interest in the CDCP business to the Stock Exchange’s registered capital. The year 2012 demonstrated expansion of activities and services when the Central Depository begun to issue LEI codes pursuant to the international ISO standard 17442 as the pre-LOU. From the position of Central Depository the year 2017 was seen as a success mainly for two reasons. The first one is a successful transition of the Central Depository to the European platform Target 2-Securities (T2S). By transition to T2S the effort of CDCP and its participants to harmonise securities settlement services with practices of the European Depositories and full integration to the Single European Capital Market together with participants of the Capital Market in Slovakia was accomplished after several years. The second reason is continuous strengthening of the market position and keeping the positive economic trend of previous years. In 2018 the Central Depository of Slovakia demonstrated that it meets all necessary specifications and conditions required by GLEIF (the Global Legal Entity Identifier Foundation), so on the 30 January 2018 it received certificate confirming successful accreditation for allocation of LEI code to legal entities from Slovakia and the Czech Republic. Allocation and administration of LEI code is the first service of CDCP provision of which doesn’t require the client to visit CDCP. In February 2018 the EuroMTS Ltd. has started to use services of CDCP to settle the transactions in the Slovak government bonds concluded in the multilateral trading system in the segment of MTS Slovakia, what confirms that services provided by CDCP are accepted also by recognized foreign entities. Processess related to obtaining of the authorisation to operate as a central securities depository according to the Regulation (EU) No 909/2014 of the European Parliament and of the Council on improving securities settlement in the European Union and on central securities depositories and amending Directives 98/26/ES and 2014/65/EU and Regulation (EU) No 236/2012 (CSDR Regulation) were finished at the beginning of the year 2019 when the National Bank of Slovakia granted CDCP the authorisation in compliance with the CSDR Regulation. Harmonisation of CDCP processes with the European standards continued in the year 2019 by implementing the standards for processing of selected types of corporate actions. At the end of 2019 CDCP implemented to its information system functionality for automatic sending of announcements on changes in securities issues that do not trigger movement of securities on accounts. These changes are announced before their processing, what contributes to a higher awareness of CDCP participants.