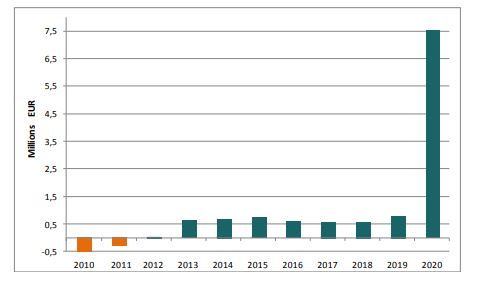

Centrálny depozitár cenných papierov SR achieved record economic result for the year 2020. Despite the COVID-19 pandemic, CDCP SR achieved profit after taxation in amount of 7,52 million EUR. The excellent economic result still follows favourable course of CDCP SR of previous years; results of the company are in positive numbers from the year 2013.

There are several reasons for the excellent results. The most significant effect had cancellation of provisions for major litigations which were decided to favour of CDCP SR. However, CDCP SR would achieve profit in amount of 2.9 million EUR even without mentioned cancellation. The substantial part of the last year’s revenues, which contributed to the achieved results, was created by fees for issuance of government bonds by the Debt and Liquidity Management Agency of SR (ARDAL). The government responded to current crisis by issuing special issues. The central depository would acquire increase in profit by 6.6 percent aslo after deducting these extraordinary incomes.

Economic results of CDCP SR in years 2010 – 2020 ( mil. EUR):

Cancellation of long-term provisions for legal disputes in amount of 5.6 million EUR due to termination of litigations to favour of CDCP resulted in exceptional decrease of costs by 75 percent, compared to the year 2019.

At the same time, CDCP SR recorded year-to-year growth in revenues by 9 percent. Total revenues were affected primarily by revenues from own services, which increased by 7 percent in the year 2020. Other services that continuously and significantly contribute to total revenues of CDCP SR were also in the previous year represented by the notary services provided to issuers of book-entry securities, administration of security owner accounts and business services for issuers of paper-form securities, which generated in 2020 revenues in amount of 4.15 million EUR, i.e. growth by 1 million EUR compared to the previous year. High revenues were achieved also thanks to registration of government debt securities in connection with requirement to fund deficit of the national budged (NB) caused by lost incomes in the NB due to COVID-19 pandemic. In course of the year 2020 CDCP registered 5 new issues of government bonds and 4 issues of government treasury bills. The second most important revenue in 2020 represented fee for administration of securities owner accounts, where the total invoiced sum was 2.97 million EUR. Compared to 2019, CDCP recorded slight decrease in revenues from fee for administration of owner account. This was related to decrease in number of owner accounts kept in CDCP; in 2020 number of accounts dropped by 5 824 accounts. The third most important revenue in last year was fee for business services provided to issuers of paper-form securities, which generated revenues in amount of 1.14 million EUR.

From gained economic result for 2020 in amount of 7.2 million EUR, the central depository set off the loss from previous years in amount of 1.828 million EUR and sum of 1.764 million EUR was contributed to retained profit from previous years. Achieved economic result allowed CDCP to compensate losses from previous periods, and in 2021 CDCP for the first time paid dividends to its shareholder – Bratislava Stock Exchange (BSSE) in amount of 3.160 million EUR.

The financial situation of CDCP was stable during the year 2020. Both current and capital expenses were financed from own funds. Positive economic result affected level of own funds, which increased by 81 percent, compared to the previous year, to level of 16.757 million EUR.

The capital expenses of CDCP reached in previous year sum of 1.428 million EUR. Investment activities were directed primarily to modifications of core production software and digitalisation project.

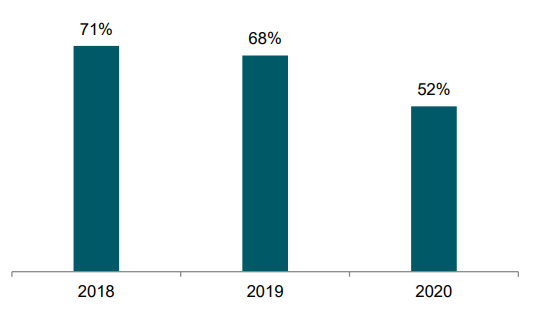

In compliance with the Regulation (EU) 909/2014 (CSDR), CDCP monitors the capital adequacy indicator, which confirms that CDCP is sufficiently capitalised against risks it is exposed to, and if required, is able to execute proper wind-down and restructuring of its activities. Lower percentage of capital adequacy in 2020 is due to positive economic result and higher own funds, i.e. in 2020 the requirement to cover these risks was on level of 52 percent of own funds, what means that amount of own funds is almost double of the risk covering requirement.

Three year trend of CDCP’s capital adequacy

In following years, the economic result of CDCP will be influenced by significant decline in number of owner accounts, registered by CDCP SR for natural persons, due to exercise of squeeze-out right by majority shareholders of companies listed on the Bratislava Stock Exchange, and since the possibility to open new accounts for natural persons in the central depository was terminated. The costs may be positively influenced by continuing digitalisation and related higher effectivity of processes, as well as by implementation of new technologies, e.g. DLT.

Author: Dagmar Kopuncová