According to the statistics of Centrálny depozitár cenných papierov SR, a.s. investor’s demand for bonds increased almost threefold in last years. Further increase is envisaged in following years.

CDCP is recording rising demand in bonds from the year 2013. This trend stems from legislative changes:

1. Act No. 530/1990 Coll. (on Bonds)

2. Act No. 483/2001 Coll. (on Banks)

3. Act No. 566/2001 Coll. (on Securities)

4. CSDR Regulation

The changes resulted to obligation of the issuers to submit the issuance terms in 15 days from issuance date. It means the issuance terms do not have to be submitted at the moment when the issue is registered. CDCP publishes the issuance conditions on its web site provided the issuer’s consent was received and on basis of request it makes the issuance terms accessible to a security owner. With regards to supervision the obligation of an issuer to submit issuance terms to the NBS and to inform the NBS on late redemption of yields from bonds was removed. Another important change was amendment to the act on banks, which replaced the mortgage bonds with covered bonds. Important was also adoption of the LEI code in our law.

Interest of the issuers in bonds issuing

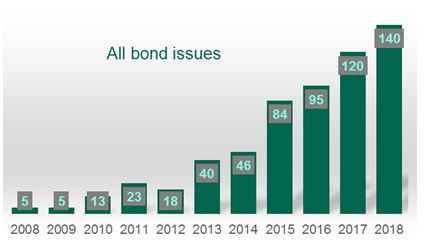

Statics of all bond issues shows that while 18 issues was issued in the year 2012, in the year 2018 was registered 140 new issues of debt securities. Closer examination revealed that share of bonds issued by non-financial institutions increases significantly. „Number of bond issues issued by issuers other than government or financial institution increased almost six times in last five years. Such bonds created about 80% of total number of new bond issues“, stated Martin Wiedermann, Managing Director of CDCP. In this group of bonds the highest demand was registered in covered bonds. Last year the covered bonds created share of 29.29% from total number of new issues.

Number of new bond issues (2008 – 2018)

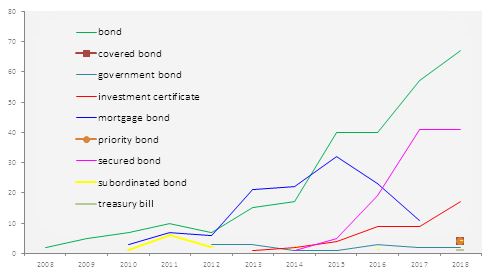

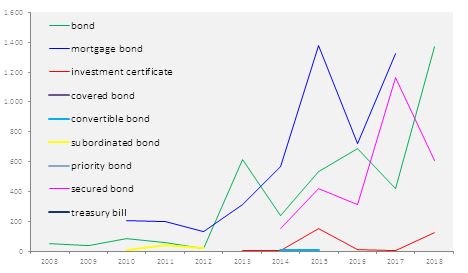

Concerning the value of new issues we can notice that government bonds and treasury bills prevail. In the year 2018 they created 73.59% of total value of issued bonds. Other types of bonds created 26.41% of total value of bonds issued last year. If the government bonds and government treasury bills are excluded from the statistics, on top positions with respect to value are the bonds (42.41 %) and covered bonds (24.77 %) which, as new type of security, replaced the mortgage bonds last year.

Value of issued bonds after excluding government bonds (2008 -2018) – million EUR

Do you intend to register bonds?

Issuance of bonds in CDCP is simple. Sufficient is to have the ISIN code assigned to particular issue, to have a LEI code, be compliant with CDCP requirements for provision of the service and pay corresponding fee. Particular requirements are defined in the Rules of Operation and the Scale of Fees of the central depository. These documents will provide you with complex information on process and terms of issue. The depository assesses risks related to provision of the service to the applicant and performs standard care according the principle „Know Your Customer“. When assessment is complete, CDCP concludes an agreement on registration of the issue with the applicant and the client gives consent with the general terms and conditions. Template of an agreement and the general terms are published on web site: https://www.cdcp.sk/cdcpweb/emitenti/dokumenty-pre-zaknihovane-cp/ .

Increased demand for bonds in last years is a not short-term experience. It is envisaged that increased interest in issuance of bonds can be expected yet. Nevertheless, further development of investment environment in the Slovak capital market is required.

(Author: M. Wiedermann)